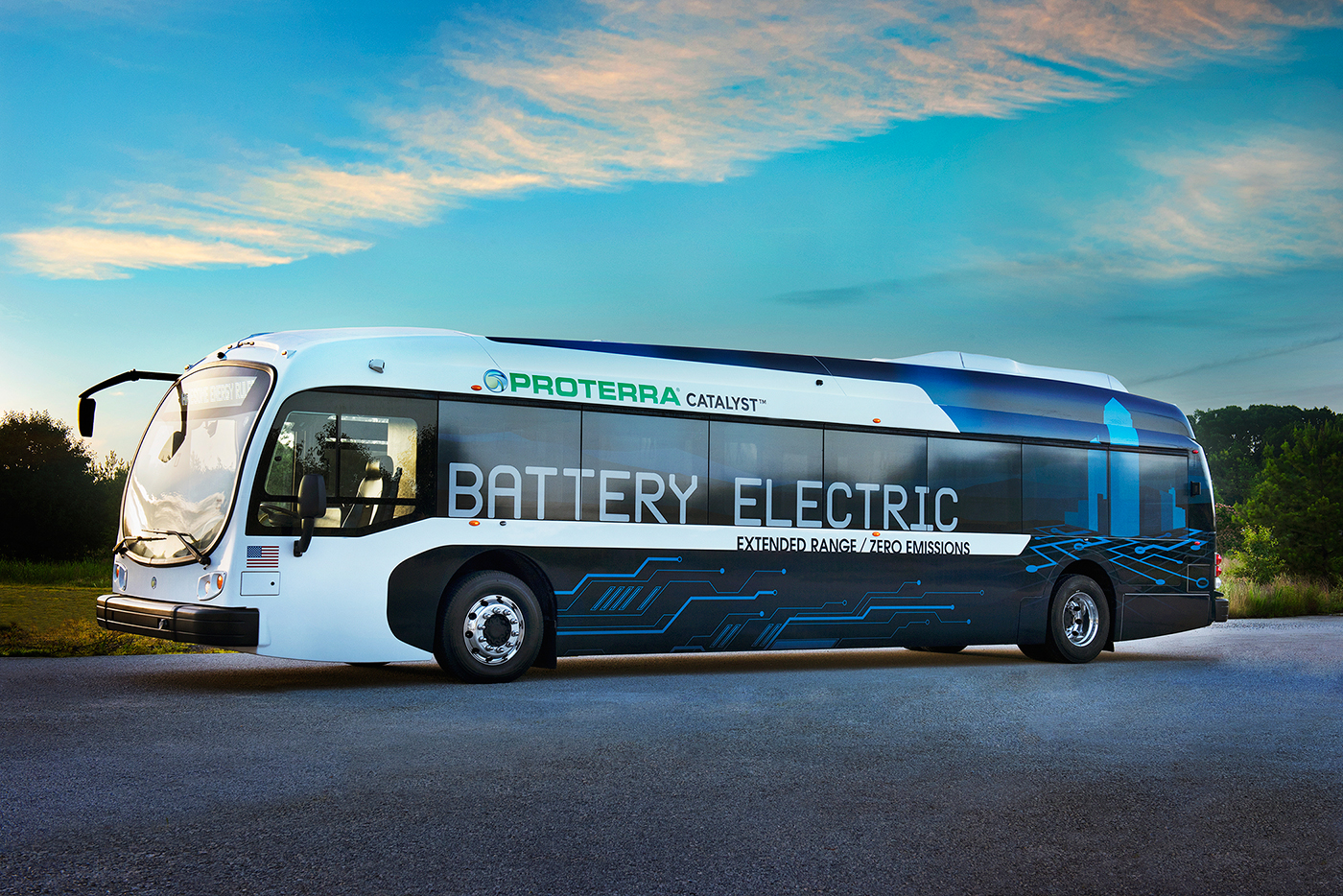

.jpg) Ryan Popple is the CEO of Proterra (http://www.proterra.com/), the leading manufacturer of Electric Vehicles (EVs) for the transit industry. Proterra vehicles replace diesel, hybrid and CNG buses in communities across the country. Its vehicles have logged more than 2,000,000 service miles in ten cities across North America, eliminating nearly a half-million gallons of diesel consumption and reducing almost 8 million pounds of air pollutants. Proterra is an integrated technology and manufacturing company, with engineering and manufacturing teams in California and South Carolina.

Ryan Popple is the CEO of Proterra (http://www.proterra.com/), the leading manufacturer of Electric Vehicles (EVs) for the transit industry. Proterra vehicles replace diesel, hybrid and CNG buses in communities across the country. Its vehicles have logged more than 2,000,000 service miles in ten cities across North America, eliminating nearly a half-million gallons of diesel consumption and reducing almost 8 million pounds of air pollutants. Proterra is an integrated technology and manufacturing company, with engineering and manufacturing teams in California and South Carolina.

Prior to his role as CEO of Proterra, Ryan was a partner at the venture capital firm Kleiner Perkins Caufield Byers. He was an early employee of Tesla Motors, where he served as senior director of finance, with a focus on strategic planning, technology cost reduction and corporate finance.

Tell us a little about the background of Proterra. How did the company get its start?

Like many technology companies, Proterra started out as an engineering-focused startup. It was really in R&D mode for the first several years, which was a good idea. It kept a very lean, focused footprint, and it really had no resources other than people in product development and engineering. The founder of the company, Dale Hill, (who’s still with the company) worked on a couple of projects during the beginning of hybrid vehicle adoption in the transit industry, and he learned a lot from hybrid technology. He thought, “why not keep going with this?” If you could extend the capability of the electric drivetrain a little bit further, and you could get rid of the internal combustion engine altogether, you could move this to where this market ultimately needs to go, with a zero-pollution vehicle that is extremely energy efficient. So he started this out really on friends and family capital--a very tight budget, and the company applied for and was awarded an initial R&D grant to build three battery-electric vehicles for deployment in L.A. County at Foothill Transit. It was funded out of a program that was trying to stimulate the development of 21st century transit vehicles. The program had a lot of objectives, and the administrators of the program didn’t know whether it was going to be a fuel-cell vehicle, a battery-electric vehicle or something else that was going to fit the technical need for the future transit vehicle. So Proterra actually worked on both hydrogen fuel-cell and electric versions of transit buses, until it really nailed it and engineered an electric vehicle that is purpose-built and very well suited for the transit market.

Where are Proterra buses currently in operation, and how do you manage expansion, since I’m guessing there’s significant lead-time and orders are pretty customized?

It’s a high price-point capital asset. Whether you’re selling boats or airplanes or transit buses or even heavy trucks, if a customer is going to spend millions of dollars on a product they tend to have an opinion on how they want the product configured. On some level though, it’s easier than what you’d experience in light duty automotive. There are more permutations of the Ford F150 pickup truck than anything that we have to deal with from a transit perspective.

In terms of places where you can find our product, there are actually a lot of wonderful cities where you can visit and ride Proterra buses today. Among others, they’re in Seattle, Foothill Transit (L.A. County), San Antonio, TX, Tallahassee, FL and Worcester, MA. At this point, 15 cities across the county have bought Proterra battery-electric vehicles, with more on

the way. It’s by far the largest deployment of zero-emission vehicle technology that’s ever occurred in the U.S. transit market. We do spend a lot of time working on growing the market, but the market’s turned, and we get pulled into more conversations at this point than we push ourselves into. So a lot of our time right now is spent on efficiently scaling the business. We have to build this business to supply a thousand transit buses per year. And that would make us a top transit provider, but by no means the leading transit provider. We’ve got a lot of growth ahead of us.

Your website talks about sourcing more than 75% of components for Proterra buses here in the U.S. Why has Proterra chosen to commit to manufacturing here in the U.S., and what has that meant for the company?

If you’re going to ship to municipal transit agencies that receive some of their funding from the federal government, you have to comply with a regulation called Buy America. There are many elements to Buy America, but two of the most critical are that you have to do assembly in the U.S. and you have to source at least 60% of your material content in the U.S. That requirement increases to 70% by 2020. We are ahead of the game and, as of this year, we are at 75%. There’s certainly a regulatory factor, but actually I think that at this stage in the market, whether there’s a Buy America regulation or not, we would choose to build these vehicles in the U.S. and we would choose to use a U.S. supply chain. Based on my experience with Tesla Motors, the outsourcing discussion for a lot of industries has been overemphasized. There are a lot of companies out there that would be much better off building a higher quality product than chasing the lowest dollar cost of labor with foreign manufacturing. The best electric vehicle technology in the world is in the United States right now. If you look at what Tesla is doing and what GM is doing with the new Chevy Volt, the U.S. is leading the world in electric vehicle technology. And so I think it’s a huge advantage for Proterra.

I really think there’s a lot of interesting stuff going on in manufacturing and the on-shoring of manufacturing. I think that’s much more the future of the industry than building a bunch of stuff in high volume, sticking it on a shipping container, floating it across the ocean and have it arrive in its market just about the time it’s going obsolete. The world moves fast from an innovation perspective. This is really challenging stuff, it’s really demanding, so I think we have a huge advantage in keeping our folks in the U.S. for now.

Can you talk about the differences in marketing a B2B or B2G product like Proterra’s, compared to someone like a Tesla which gets a lot of attention because it’s more consumer-facing?

B2C and B2B are very different, especially from a customer adoption perspective. If you look at what Tesla’s doing right now, I think they’ve segmented the market very wisely along performance lines. They figured out how to build extremely high performance vehicles that outperform other high performance vehicles that run on combustion engines. And they’re gradually working down market, taking it from the top-down. The things that resonate with their customers are high performance, safety, environmental sustainability and differentiation. There’s a lot of boredom in automotive right now. In their market, a Tesla is something unique. Some of those factors carry over to how we market, but some are very different.

The number one thing that drives the sale for us is fuel savings; it’s economics. One of the big differences between our market and the light duty vehicle market is that our customer is much more sophisticated about fuel costs and about managing that exposure. We sell vehicles to customers who have to live with those vehicles for 10-15 years. We typically do business cases and analysis with our customers, because our orders are very large—they’re five, ten million dollars or higher. You’re going to end up talking to their CFO before that deal gets signed. It’s a different sale; it’s an enterprise sale, it’s a slower sales cycle but a bigger order. We are whale hunting; we’re not out there trying to get large numbers of small orders. We’re looking for a small number of large orders.

I think it’s actually easier to market electric vehicle technology to transit customers than it is to light duty vehicle drivers. The U.S. driver has some of the shortest term memory of any energy consumer in the world. Oil is cheap right now, and you have U.S. car consumers buying pickup trucks and SUVs in record numbers. And that’s just a terrible idea, but people do it. Just as soon as we get all of these pickup trucks and SUVs on the road, oil prices will be right back where they were. Our customers are sophisticated, they’ve lived through oil crises. It’s much more fun to talk to a sophisticated fleet customer about electric vehicle technology than someone who walks into a car dealership.

What’s it like to be a middle market company in Silicon Valley? Do you find that you face competition for employees from both the larger companies and the startups?

What’s it like to be a middle market company in Silicon Valley? Do you find that you face competition for employees from both the larger companies and the startups?

We refer to ourselves as a late-stage technology startup. As a technology startup in Silicon Valley and with our location in South Carolina, we do want to hire people from large companies, and we also want to hire people from cutting-edge startups. We want to appeal to both ends of the spectrum. What we’ve found is that a lot of people who are interested in a technology startup, they like Proterra because there are a lot of proof points already on the board. You can join a startup and it’s possible that it never gets into revenue. Ours is a very tangible business, with more than a year of order backlog. The technical risk of the product has largely been removed at this point.

If someone is leaving a Ford or a GM, they would probably be more comfortable at a technology company like Proterra than they would be at a pre-revenue startup with very little funding and with a short window to take a shot at an idea. On the other side of the spectrum, we’re getting a lot of traction with people from larger tech companies as well—Google, Apple, Tesla. We’re attracting people who want to work on something where their efforts are highly correlated with the outcome of the business. They want a role with a lot of responsibility; they really want to know that their work “moves the needle.” When a company gets to twenty thousand employees, it’s hard for people to feel that way. This is a 200 person company, so there’s high accountability and high transparency. And it’s a really cool mission. We take a lot of personal pride in the fact that the product we make literally makes U.S. cities cleaner and the air healthier. People here have a lot of passion; and if you’re recruiting employees, giving them something they can have a passion about, that’s special.

What’s next for Proterra? What are you most excited about?

We will be opening our second factory, on the West Coast. We’ll be growing revenue while opening a new plant, so we’ll be carefully replicating everything we’ve learned at the first plant. We need the capability to build on both the east and the west coasts, because we’ve got so much demand in both regions. So we’re working on opening our factory in L.A. County, and we hope to be shipping vehicles out of there shortly. We’re also trying to get electric vehicle programs going with every U.S. city across the country. There’s a billion dollars-plus of interest in what we’re doing right now. We’re in fifteen cities right now, but we want to be in five hundred U.S. cities; corporate and university fleets as well. There are seventy thousand diesel buses on the road that make our air less healthy. Diesel is the most dangerous transportation pollutant out there. Nobody should be running diesel buses five years from now, but we know it won’t be that easy.