The Middle Market segment is experiencing fast, steady growth due largely to a knack for adaptability and resilience. There are 3 key needs that middle market companies are asking us to collectively solve for and we’re seeing success with Middle Market digital solutions that are meeting these needs.

Recently, I had the opportunity to lead a session at Visa Payments Forum 2023 in San Diego. This is a major annual event on the Visa calendar featuring presentations, content, and exhibitions about all things payments. The attendees included customers, partners, fintechs, and others within the commercial payments ecosystem. What made this year so special is that for the first time, the Middle Market was included on the roster of carefully curated forum sessions as a story worth telling among many other important topics including expert perspectives on the future of payments and the trends and innovations that are driving that future.

I had the privilege of advocating for the digital, cash flow and payment needs of these powerful and important companies in the US Economy to a large audience of industry experts. While the Middle Market may have been new to attendees, this is a segment that I have studied – alongside the National Center for the Middle Market – for over five years. This is a segment that I’m passionate about given their unique characteristics and significance in the US Economy. So, it was especially rewarding to be able to share and talk about the impressive adaptability, resilience and loyalty these companies often exhibit, as well as their unique challenges and pain-points when it comes to the needs of their businesses. I’d like to share some of the themes and stories back with you as well.

The Impact of being in the Middle

The Middle Market segment is experiencing fast, steady growth due largely to a knack for adaptability and resilience. There are 3 key needs that middle market companies are asking us to collectively solve for and we’re seeing success with Middle Market digital solutions that are meeting these needs.

Unique company characteristics mean a need for specific products

Key characteristics according to NCMM – 87% of MM companies are privately owned – these companies answer only to themselves – they have an independent spirit which shows up in their business culture. This is a characteristic we keep in mind when designing Middle Market solutions – our goal is to meet Middle Market companies where they’re at and deliver solutions that resonate with their unique needs.

In many cases the current owner will be leaving their company to their children, family member or employee who is millennial or Gen Z. So, as MM company owners have been building their core business over the past two or three decades … their kids have grown up on Insta, Snapchat and Tick Tock so digital solutions are not only expected but are second nature.

MIDDLE MARKET COMPANIES CAN ADAPT, THEY SURVIVE THE TOUGH TIMES AND THEY’RE RESILIENT

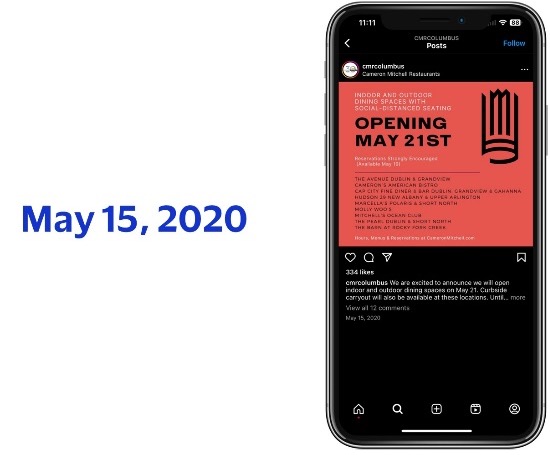

They can adapt. They survive the tough times. They’re resilient. And their growth remains more consistent historically than larger companies – S&P 500 (NCMM). This story about the Cameron Mitchell restaurant group is the model of Middle Market adaptability and resilience. Cameron Mitchell founded his restaurant group in 1993 – headquartered in Columbus OH - this is an independent, privately held company known for developing & operating terrific restaurants – for example, you might be familiar with Ocean Prime with locations throughout the country. Here is one of Cameron Mitchell’s social media post’s this one from March 13, 2020:

Excited. For the weekend.

We all know what that weekend was like …

The world stopped.

And for Cameron Mitchell this meant closing all 45 of their restaurants.

Why?

Because they were all dine in.

This business went from $325M in annual revenue as of March to $0 revenue in April 2020.

His team needed to quickly adapt to a new model – Carry Out and Curbside Pickup.

He wasn’t alone – we of course saw many restaurants doing the same.

But think about it … this a Middle Market company … this isn’t one restaurant this is a $325M business.

Dozens of restaurants. Hundreds of employees and thousands of customers depending on their business.

At the time of this post – April 30, 2020 – Cameron Mitchell had no revenue coming in.

If this had been your customer it also means that they stopped buying food, aprons and equipment.

By May 2020 – less than 50 days later - Cameron Mitchell was back on his feet during a time when smaller restaurants were failing and larger companies were having trouble adapting.

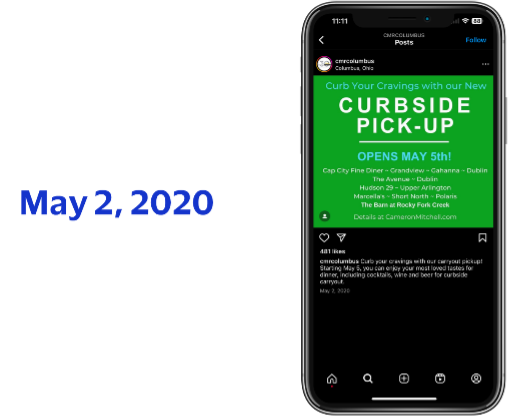

For Cameron Mitchell, his customers were now ordering online and picking up at the curb.

It also meant that he was not only back in the business of buying food, aprons, equipment for his restaurants but had expanded purchases to new suppliers to support his new business model.

That is adaptability. That is adaptability at lightning speed.

That’s not all … by that same May, 25% of their restaurants were open, they were taking care of the employees, their company culture had never been healthier, they were even looking at acquiring smaller, less stable restaurants, they were profitable and in their words ‘lived to fight another day’.

That is resilience.

Today the restaurant group continues to grow their core business and operate several related businesses and are partnering to open a boutique hotel in Dublin OH in 2026. MM companies as a customer are going to pivot in the face of challenges and recover quickly – come out stronger - this is what makes them so great for your business.

There’s one more thing that sets MM companies apart. Yes, they’re adaptable. Yes, they’re resilient. But they’re all deeply loyal. In fact research shows that, Middle Market companies spend 16 years or more w/ their primary bank & use a majority of their products at their primary bank.

But what would make a MM company that is so loyal – leave their primary bank? If their bank isn’t offering them what they need – and their need right now more than ever is … Digital payments

Many think that it’s all about credit underwriting. It’s not … these companies need the right solutions. So … what are the right solutions? Look for part 2 of this blog coming August 1!