Other Key Findings:

Global and U.S. confidence remains muted

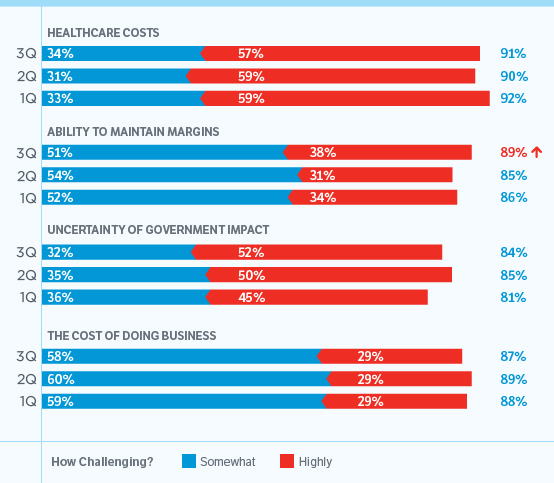

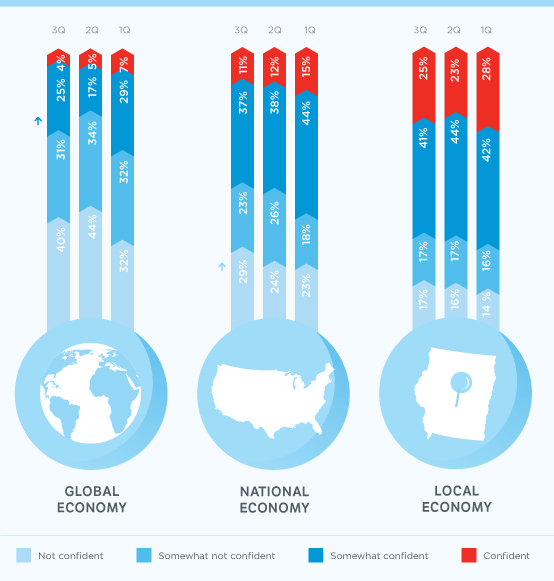

The middle market overall continues to show a lack of confidence in the

global and U.S. economies – highly concerned about health care costs,

the ability to maintain margins, the cost of doing business and

uncertainty regarding government actions. More than 70% of the middle

market said they were not confident or somewhat not confident about

global economic prospects. Concerns about the U.S. economy worsened

slightly in the quarter; 52% of respondents said they were not confident

or somewhat not confident about the domestic economic outlook, compared

with 50% in the

previous quarter.

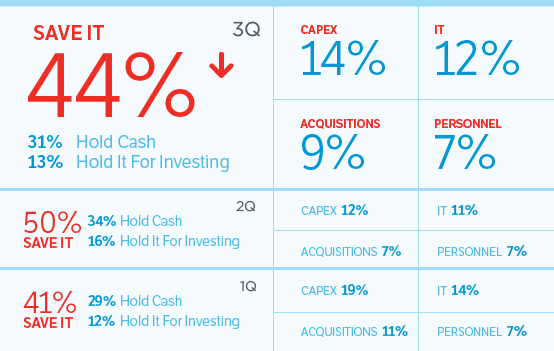

Future investment outlook remains cautious

Middle market companies remain hesitant to invest additional cash,

extending their habit of postponing investment opportunities. The number

of companies who said they would hold cash dropped in the third quarter

from 49% to 44%, providing a glimmer of hope that the middle market may

start investing in capital expenditures, expansion or other areas that

could fuel growth. However, that number lags first-quarter results when

41% said they would hold excess cash.

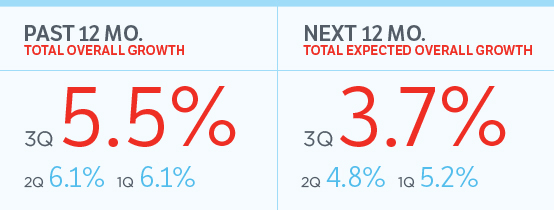

Next 12-month revenue expected to soften

Middle market companies expect gross revenue to gain 3.7% in the next 12

months, a decline from second quarter expectations of 4.8% and 5.2% for

1Q expected growth. All revenue segments expect some decline and there

was a sharp drop off in the number of firms expecting to grow more than

10%. Only 17% of all respondents in the survey said they expect

double-digit revenue growth compared with 23% in the prior quarter, and

28% in Q1.

*Revisions

to the 1Q mean revenue and employment scores have been adjusted using

the Winsorization Method to adjust outlier values in the distributions.

The extreme values have been replaced by trimmed minimum and maximum

(values representing the middle 95th percentile of each overall

distribution within the survey instrument). In addition, the means have

also been rebased so that they are reflective of the Middle Market as a

whole and not solely the proportion of the market experience growth or

contraction.

Challenges persist

A large majority of leaders at middle market companies cited uncertainty

about healthcare costs as their major challenge, a persisting concern

as healthcare and other regulations remain in flux. The same concerns

were highlighted in Q1 and Q2 surveys. In addition, middle market

company leaders expressed a rising concern with their ability to

maintain margins and the cost of doing business, indicating that they

are having trouble and foresee difficulties in rising prices and passing

on increased costs to customers.