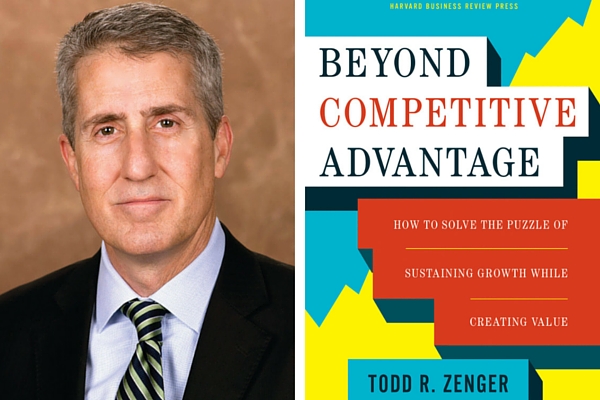

Todd Zenger’s new book, Beyond Competitive Advantage, isn’t just about identifying and leveraging a single competitive advantage, but explains how companies can create big ideas, long-term theories of value that sustain business growth and generate multiple competitive advantages over time. Examples of these big, organizing “corporate theories,” as Zenger describes them, include Disney’s focus on leveraging great animated characters across all media, Apple’s long-held commitment to designing great consumer electronic devices that elegantly integrate hardware and software, and USAA’s focus on providing financial services to fit the unique needs of military families.

Zenger, a global expert on strategy and strategic leadership (as well as the N. Eldon Tanner Chair in Strategy and Strategic Leadership at the David Eccles School of Business at the University of Utah), spoke with us recently about business strategy.

How do you define an effective corporate theory?

An effective corporate theory is able to consistently reveal strategic experiments and actions that a firm can take that are likely to generate new value.

A good corporate strategy has three “sights.” It articulates foresight, beliefs about future technology, market demand, and an industry’s evolution. Insights about what’s unique and distinctive about the firm, or what you’d like to develop that’s distinct and unique. And finally, it reveals cross-sights, which are new opportunities or new assets that can be combined with a firm’s existing assets to create new value.

How does the example of Walt Disney illustrate a great corporate theory?

It’s classic that Walt Disney would have created a visual corporate theory, which I display in the book. This drawing shows that the central asset of the firm is animated films, and then emanating from that were arrows going to other assets in the Disney portfolio, such as books, theme parks, hotels, etc. And each arrow is precisely labelled with synergies flowing from the central asset to the peripheral assets, and vice-versa.

These connections are the cross-sights inherent in the theory. What’s remarkable is how easy it is to identify other types of opportunities that fit with Disney’s corporate theory, such as cruise ships or Broadway shows or anything allowing you to replicate fantasy worlds. Sometimes, Disney has a cost advantage or a differentiation advantage, but their theory allows them to see strategic actions that can help accumulate competitive advantage across a number of businesses.

Do you see an implicit rejection of corporate theories with the popularity of agile or dynamic approaches to business?

The notions of agility and dynamics, which mean doing a lot of activities fast and then collecting feedback on what works or doesn’t, is a bit like telling a scientist to just run a bunch of random experiments. The development of a corporate theory enables you to develop better experiments. Yes, you will need to carry out experiments, but developing good theories first allows you to carry out better ones.

You describes how the uniqueness of a corporate theory can create a paradox. How?

The paradox is that value is created by your unique theory, which allows you to accumulate assets at a discount. But you also need to finance your activities. You face an investor pool that doesn’t understand your theory, and as their uncertainty about your theory grows, so does your cost of capital.

Firms face lots of pressure to adopt theories that are more easily analyzed, because doing so may attract more analyst coverage and reduce market uncertainty. There’s a tension between developing unique theories of creating value and pandering to the market. Some firms will simply go private, and/or find more patient investors who will seek to understand their corporate theories. But nothing fully resolves the paradox.

Why does identifying, and then maintaining, a single, value-generating position NOT create sustainable market value?

Let’s look at a company like Wal-Mart, for example. It has created a position that creates tremendous value, but they’ve plateaued. It’s not that Wal-Mart’s growth has slowed, but they’ve been playing things out from the same position. They’ve struggled to find new positions or to demonstrate to capital markets that they can succeed in a big way in global markets. Despite maintaining a great position, they haven’t demonstrated new, unexpected value.

How is corporate structure, much like strategy, a dynamic thing?

Companies swing back and forth with structuring because there are basic tensions at play, such as between innovation and efficiency. It can be a bit like tacking a sailboat back and forth, which can create forward momentum. I was just reading about P&G finding success for many years in driving innovation. But now they need to cut costs, so their new CEO is driving initiatives to do that. Will this cost-cutting hurt innovation? Yes.

A study by a former student and some colleagues of mine categorized CEOs as “output” CEOs or “throughput” CEOs. “Output” CEOs focus on top-line growth, while “throughput” CEOs focus on cost control. What they found is that the longer an organization has an “output” CEO, the higher the chances they’ll be followed by a “throughput” CEO, and vice-versa. Great leaders, such as GE’s Jack Welch, are much like chameleons who are able to tack over time.

You describe great leaders as both musical composers and conductors. How so?

Great leaders are really good at composing corporate theories that guide the assets a firm assembles; they then determine the kind of experiments a firm will run. Great strategic leaders must also organize their assets on an continuous, dynamic basis, as a conductor does. Leaders are faced with choices all the time. For example, integration may work for a while, but then you may need to outsource the activity; you may be centralized and then need to decentralize. Getting the timing right is key.

How might the strategic ideas in “Beyond Competitive Advantage” apply to middle market companies?

When you look at companies like Apple and Disney, which are core examples in the book, you see that these now-big companies were in their very early stages when they composed their theories of value that guided their strategic moves over long periods of time. I’d give the same advice to companies in their middle stages, or early stages. The application of these ideas isn’t limited to one size of company.