PIPELINES, PRICES, AND PLANNING FOR CONTINUED GROWTH

The Q4 MMI—and every quarter of 2017—has been rosy. But a couple of dark spots are embedded in it. One is a softening in the new order pipeline: Companies reporting increases in their pipelines dropped from 41% in 3Q to 35% in 4Q. That remains a strong number (it compares to 31% in 4Q 2016) but it was enough to pull down the short-term index. Of more concern: Among those with larger new order pipelines, the average amount of the increase fell all year, from 18.4% to 12.1%.

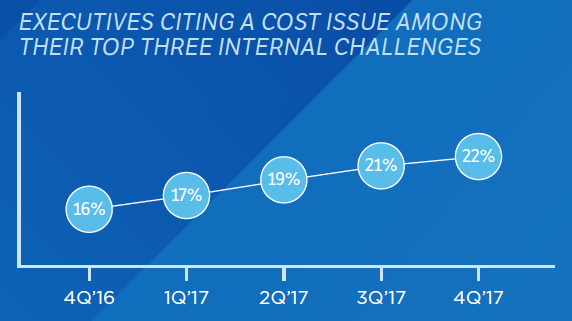

At the same time, anxiety about costs has risen for four straight quarters. While a cost issue is named as a top-three concern by just 22% of executives (vs. 50% who name a talent issue), that figure was 16% a year ago. One person’s cost increase is another person’s price increase, and we see that, too: 48% of companies expect to raise prices next year, which is up eight points from 4Q’16 and the highest number we have seen. Executives worry especially about managing healthcare costs (particularly at smaller firms). These data do not reflect whatever impact tax-law and other policy changes may have on costs or other aspects of business.

The picture points to growing complexity: While growth and profitability continue to be very strong, executives say the challenge of managing and sustaining them seems more difficult. The level of concern for all long-term business issues—not just costs—has risen in the last year. Not surprisingly, the two subjects that top leaders’ lists as things they want to know more about are strategic planning and creating a high-performance culture—both capabilities that will help a company handle whatever curveballs the economy throws at them.