Other Key Findings:

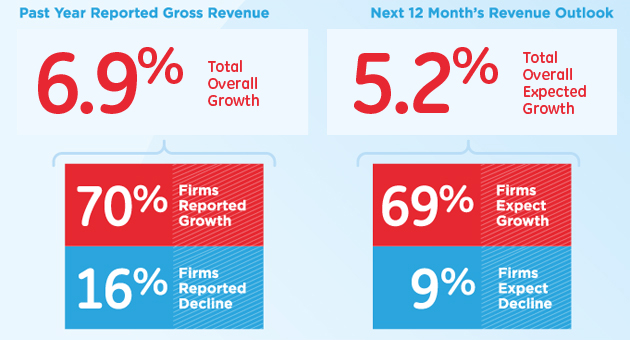

Middle market companies continue to grow

Revenue continues to grow with 63% of firms saying that gross revenue grew during the past 12 months. That’s down slightly from the fourth quarter of 2012. The mean revenue growth fell to 5.8%, with most of the decline coming from the largest middle market companies. Companies also expect performance in the coming year to be better with 64% projecting revenue to grow, although at a slightly lower average of 4.9% than the 5.2% average at the end of the fourth quarter.

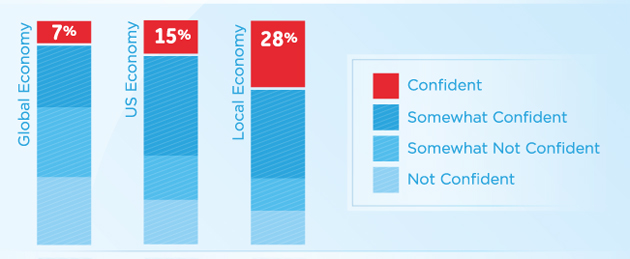

Confidence in the economy is a notable concern

As businesses look beyond their local economies, their confidence levels

deteriorate. Only 15% of middle market businesses are confident in the

U. S. economy, only 7% are confident in the global economy, yet 28% are

confident in their local economy.

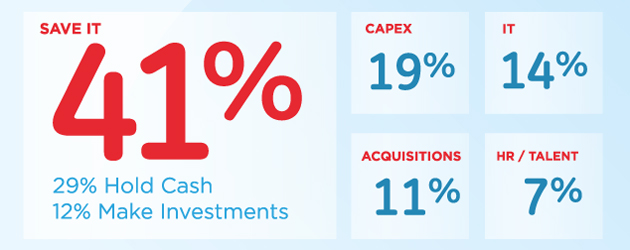

Firms are cautious about future investment

Among middle market executives, 41% said they would save extra cash,

either to bolster cash reserves or to make future investments. The

remainder would reinvest either for capital expenditures (20%),

technology (14%), acquisitions (11%), HR/hiring (11%), or other (3%).

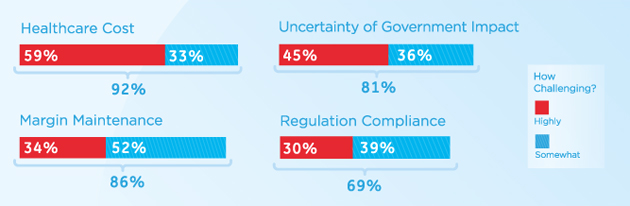

Policy and regulation post critical challenges

More than half (52%) of middle market companies see the regulatory

environment as more restrictive than previously, with only 4% indicating

it is less restrictive. Middle market companies cited four major

challenges as more intense than others; reported as highly or somewhat

challenging were: the cost of health care (92%), uncertainty over how

government actions will impact business (81%), the ability to maintain

profit margins (86%), and ensuring compliance with new regulations

(69%).